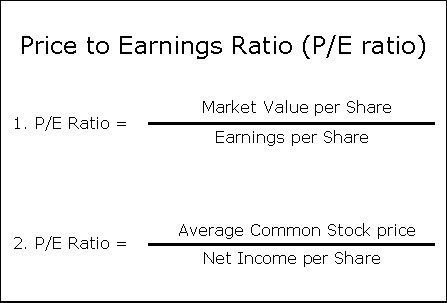

Price earnings ratio formula

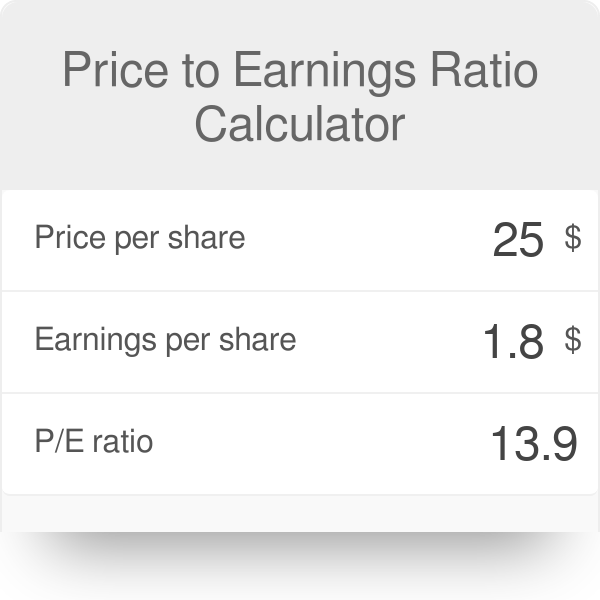

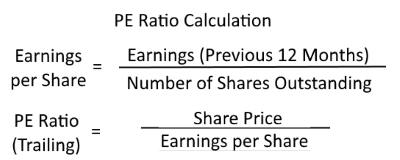

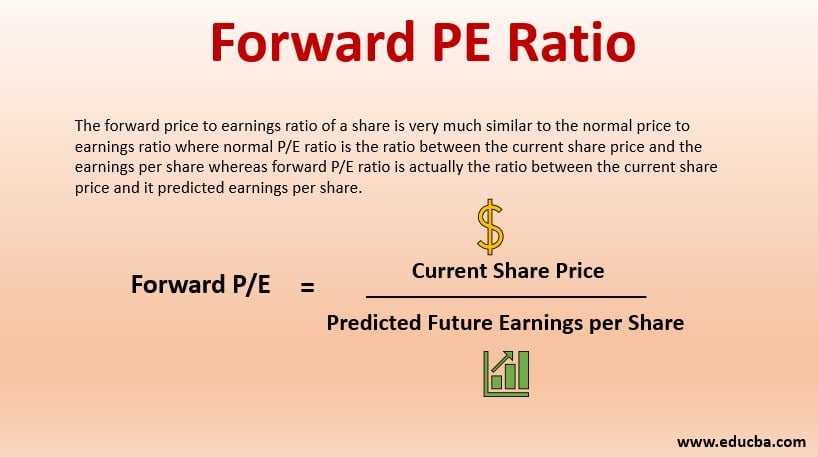

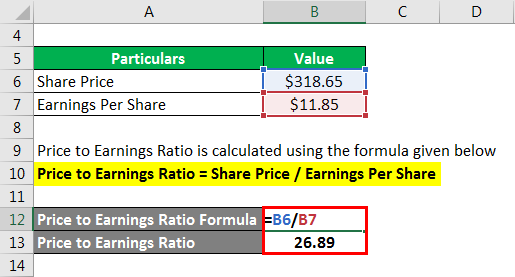

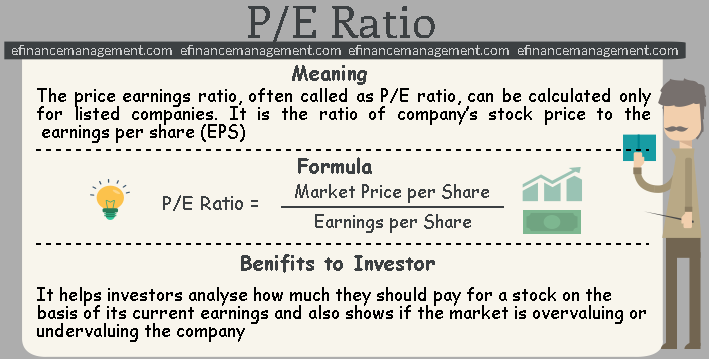

Analysts and investors can consider earnings from different periods for the calculation of this ratio. PE Ratio or Price to Earnings Ratio is the ratio of the current price of a companys share in relation to its earnings per share EPS.

Price To Earnings P E Ratio And Earnings Per Share Eps Explained Youtube

Since it is the indicator of how much net profit has been earned if a company has higher basic earnings per share Earnings Per Share Earnings Per Share EPS is a key financial metric that investors use to assess a companys performance and profitability before.

. The market price of an ordinary share of a company is 50. 50 5 10. The PEG ratio formula for a company is as follows.

However the most commonly used variable is the earnings of a company from the last 12 months or one year. Based upon its fundamentals you would expect PG to be trading at 2233 times earnings. A price-earnings ratio is a figure that shows the proportionate difference between a companys current share price and its earnings per share.

What is the PEG Ratio Formula. Ending RE -10000 Anand Pvt. A PEG ratio greater than 10 indicates that a stock is overvalued.

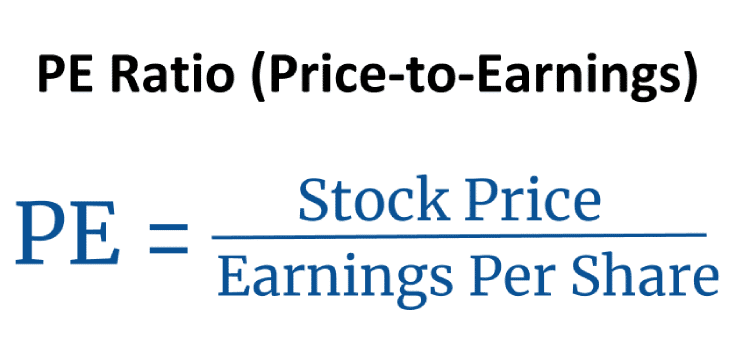

The price earnings ratio of the company is 10. Price-Earnings Ratio - PE Ratio. The price-earnings ratio PE ratio is the ratio for valuing a company that measures its current share price relative to its per-share earnings.

The quick formula for Earnings Yield is EP earnings divided by price. Using the example shown in the table at the top of this guide there are three companies we can compare Fast Co Moderate Co and Slow Co. It denotes what the market is willing to pay for a companys profits.

The earnings per share is 5. The price-earnings ratio can be estimated based upon these inputs. The PE Ratio helps investors gauge the market value of a share compared to the companys earnings.

How Does the PE Ratio Price to Earnings Ratio Work. The market basket is crated based on surveys and it should be reflective of the day-to-day consumption expenses of the majority of consumers. It means the earnings per share of the company is covered 10 times by the market price of its share.

The priceearnings to growth ratio PEG ratio is a stocks price-to-earnings PE ratio divided by the growth rate of its earnings for a specified time. The first companys share price may be higher but a PE ratio of 15 means youre only paying 15 for every 1 of the companys earnings. In other words 1 of earnings has a market value of 10.

As retained earnings are calculated on a cumulative basis they have to use -10000 as the beginning retained earnings for the next accounting year. Ltd has to need to generate high net income to cover up the cumulative deficits. PriceEarnings To Growth - PEG Ratio.

The earnings yield is the inverse ratio to the price-to-earnings PE ratio. The price-earnings ratio PE Ratio is the relation between a companys share price and earnings per share. Ending RE 30000 40000 0.

Investors in the company with a PE ratio of 30 are. PEG Share Price Earnings per share Earnings per Share growth rate. The yield is a good ROI metric and can be used to measure a stocks rate of return.

For example it helps figure out the price-earnings ratio of a comparable company. The formula for the PEG ratio is derived by dividing the stocks price-to-earnings Price-to-earnings The price to earnings PE ratio. Has a deficit of 10000 at its business.

The formula for computing the PE ratio is. Firstly select the commonly used goods and services to be included in the market basket. Compute price earnings ratio.

Multiplied by the current earnings per share you get a value per share of 6699 which is identical to the value obtained in Chapter 13 using the dividend discount model. The formula for the consumer price index can be calculated by using the following steps. Read more or PriceEarnings to Growth ratio refers to the stock valuation method based on the growth potential of the companys earnings.

Example of the PEG Ratio Calculation.

Price To Earnings Ratio P E Basics Formula Calculation Interpretation Getmoneyrich

P E Ratio Price To Earnings Formula And Calculator Excel Template

P E Ratios Howthemarketworks

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts

Price Earnings Ratio Formula Examples And Guide To P E Ratio

What Is A Price Earnings Ratio P E Ratio Formula Examples

Pe Ratio Price To Earnings Definition Formula And More Stock Analysis

The Price To Earnings Ratio Trailing Pe Vs Forward Pe Ratios Youtube

Price To Earnings Ratio P E Basics Formula Calculation Interpretation Getmoneyrich

Price Earnings Ratio Calculator What Is P E Ratio

What Is The Pe Ratio How To Use The Formula Properly

Forward Pe Ratio A Qucik Glance Of Forward Pe Ratio With Example

Price To Earnings Ratio Example Explanation With Excel Template

P E Ratio Meaning Valuation Formula Calculation Analysis More

Price Earnings Ratio Formula Examples And Guide To P E Ratio

P E Ratio Price To Earnings Formula And Calculator Excel Template

What Is Pe Ratio Trailing P E Vs Forward P E Stock Market Concepts