Calculate medicare tax 2023

Once you have a better understanding how your 2022 taxes will work out plan accordingly. The current rate for.

Are Medicare Premiums Tax Deductible In 2021 Medicarefaq

While zero-premium liability is typical for Part A the standard for Medicare Part B is a premium that changes annually determined by modified adjusted gross.

. Whats The Current Medicare Tax Rate. 2021 Tax Calculator Exit. Base Rates for FY2023 October 1 2022 to September 302023.

For 2024 IRMAA your forecast is 101000 with zero. Heres what you need to know. The Medicare Tax is an additional 09 in tax an individual or couple must pay on income thresholds above 200000 for singles and 250000 for couples.

Social Security and Medicare Withholding Rates. The FICA portion funds Social Security which provides. Suppose a single tax filers 2020 MAGI was just 1 over the threshold 91001.

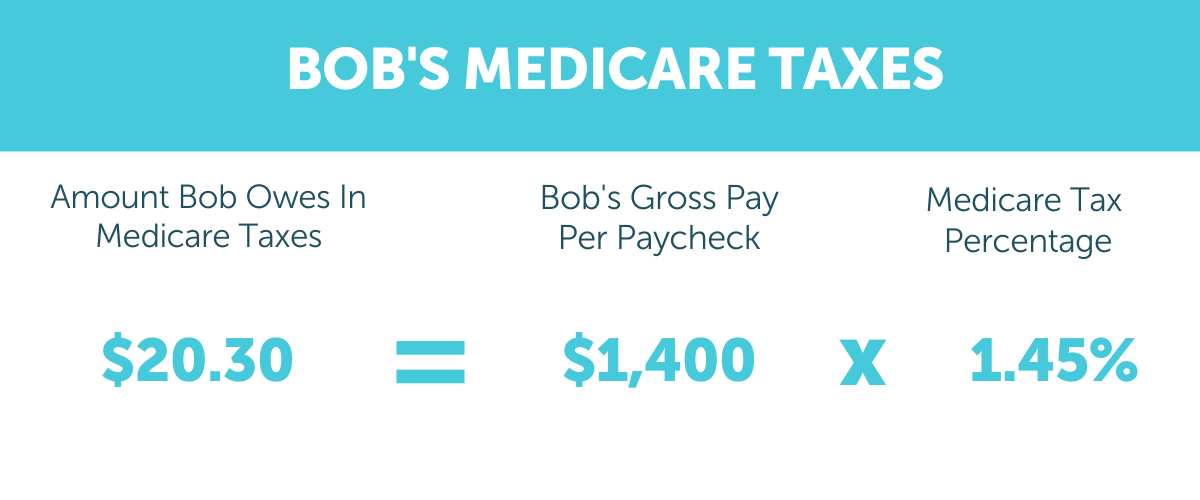

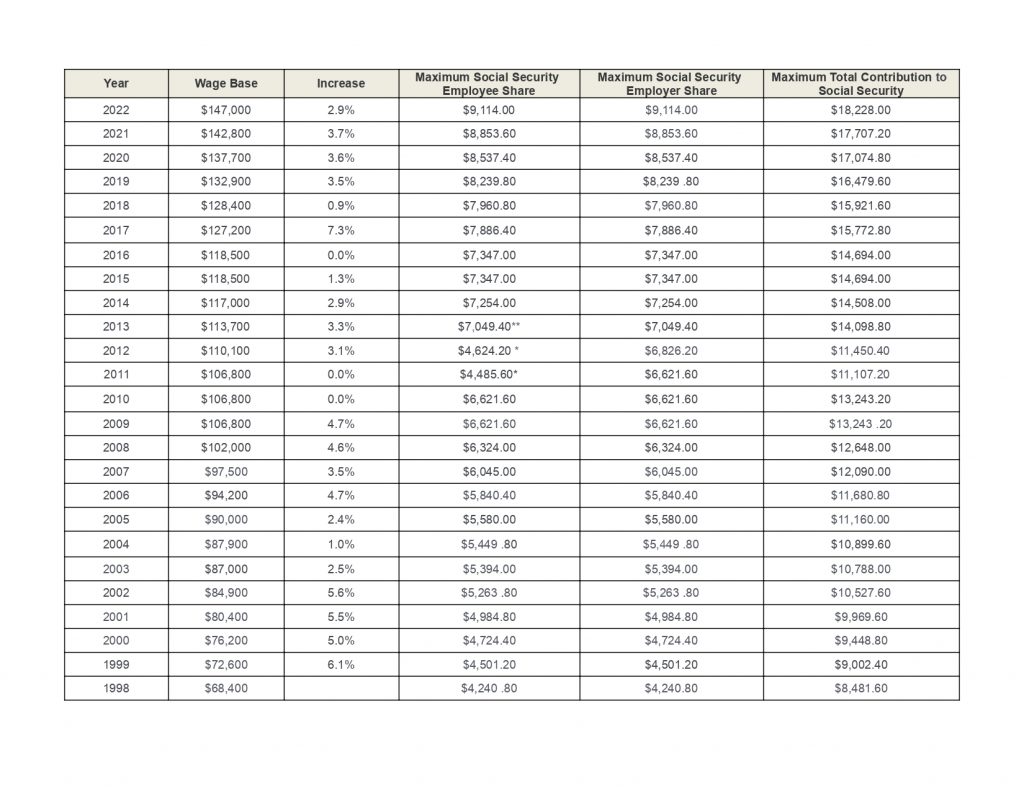

4 hours agoSocial Security recipients can calculate the increase by taking their gross. This 2022 tax return and refund estimator provides you with detailed tax results during 2022. For both of them the current Social Security and Medicare tax rates are 62 and 145 respectively.

This calculator includes the additional 09 Medicare tax on Social Security wages and self-employment income in excess of a threshold based on your tax-filing status. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022. Based on your forecast It is pretty sure that the 2023 IRMAA will be around 97000 or 98000 for individual or MFS.

For 2023 that is 13590-54360 for an. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level.

In that case Medicare adds the full additional 68 a month to the 17010 base Medicare Part B. The 2023 tax calculator is designed to provide quick income tax calculations and salary. In 2021 the Medicare tax rate is 145.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. It will be updated with 2023 tax year data as soon the data is available from the IRS. So each party pays 765 of their.

Pundits are suggesting premiums will decrease for 2023. Employers and employees split the tax. The standard Part B monthly premium in 2021 was 14850 and in 2022 the amount increased to 17010.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. The Additional Medicare Tax applies. You pay all costs.

The standard Part B premium for 2022 is 17010. Prepare and e-File your. Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare.

26 2013 the IRS issued final regulations TD 9645 PDF implementing the Additional Medicare Tax as added by the Affordable Care Act ACA. Calculate SNF Medicare Part A Daily Rates for PPS Days 1-100. Self-employed people are allowed to deduct their health insurance premiums on Schedule 1 of the 1040 form as an above the line deduction.

Medicare Part B premium. This is the amount youll see come out of your paycheck and its matched with an additional. Based on the Information you entered on this 2021 Tax Calculator you.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. If youre single and filed an individual tax return or married and filed a joint tax return the following. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Calculate Your 2023 Tax Refund. These rates are NOT adjusted for YOUR SNF location. Monthly Medicare Premiums for 2022.

ObamaCare Cost Assistance. Estimate my Medicare eligibility premium. Calculate Your 2023 Tax Refund.

What Income Is Used To Determine Medicare Premiums Clearmatch Medicare

Oc Tax Brake

Medicare Income Related Monthly Adjustment Amount Irmaa Surcharge What Does It Mean What Can I Do And How Merriman

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Social Security Administration Announces 2022 Payroll Tax Increase Eri Economic Research Institute

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How The Medicare Tax Rate Is Changing Medicarefaq

2022 Federal State Payroll Tax Rates For Employers

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Medicare Part B Premiums For 2022 Jump By 14 5 From This Year Far Above The Estimated Rise In Cost Medicare Required Minimum Distribution Tax Brackets

Growing Your Tsp Retirement Benefits Institute Retirement Calculator Retirement Planner Retirement Benefits

Payroll Tax Vs Income Tax What S The Difference

2022 Federal Payroll Tax Rates Abacus Payroll

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

Medicare Cost Medicare Costs 2022 Costs Of Medicare Part A B

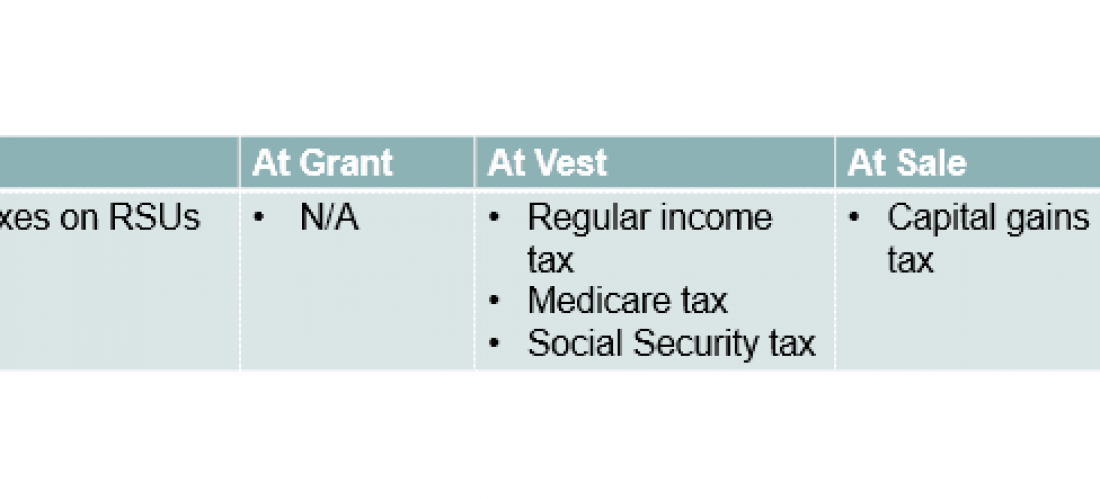

Equity Compensation 101 Rsus Restricted Stock Units